受COVID影响的雇主的财务资源

COVID危机继续影响着大大小小的企业, government entities and lending institutions are working hard to provide relief. 请 review the following information for insight into the resources that are cur租金ly available to your business.

COVID危机继续影响着大大小小的企业, government entities and lending institutions are working hard to provide relief. 请 review the following information for insight into the resources that are cur租金ly available to your business.

还记得, 当你考虑哪种选择适合你的情况时, know that the funds are only available for working capital losses due to the virus. They are not to be used for the expansion of operations or consolidation of debt. 简而言之, this financial assistance can be used to support ongoing operations and to cover the costs/expenses that are necessary to stay afloat. 私人非营利组织也有资格获得小企业管理局的救灾援助.

小企业财政援助

美国经济复苏工具箱中的一个关键工具是 薪水保障计划 (PPP), which came into existence as a way to provide financial relief to businesses with 500 or fewer employees, 非营利性组织, 退伍军人组织, 部落的担忧, 个体, 独资企业, 独立承包商. 申请这些资金的最初截止日期是2020年6月30日. 然而, as a result of the continued need demonstrated by organizations that had suffered economic hardship due to COVID, 政府将申请这些资金的截止日期推迟到了8月. 8, 2020. Additionally, on May 15, 2020, the Small Business Administration released its much anticipated PPP贷款减免申请. 最近, 综合拨款法 于十二月通过. 27, 2020, for the purposes of helping countless businesses still reeling from the COVID crisis. 请继续阅读以了解更多有关该立法的信息.

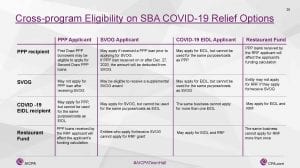

SBA COVID-19救济方案的跨项目资格

The American Institute of CPAs (AICPA) held a town-ball meeting on May 22, 2021. During that program, tax professionals shared a lot of helpful insight for CPAs as well as employers. 下面展示的幻灯片, 经美国注册会计师协会许可出版, shows the programs business owners of all types can apply for while funds are still available. Check it out below and reach out to your 意图 CPA for additional insight or if you are looking for help to apply for assistance.

点击图片查看全尺寸版本.

工资保障计划2.0

由于企业面临持续的财务困难, 立法者提出了2021年综合拨款法案. This piece of legislation addresses the tax-deductibility of PPP loan forgiveness expenses, 自动免除低于15万美元的贷款, 二次提取贷款, 延长计划资格, 和更多的. 为了您的方便, the 意图 PPP task force has provided an overview of the program and additional provisions you should be aware of moving forward. 要阅读概述, 点击这里.

首次提取贷款

IMPORTANT: The 小企业管理局(SBA) reopened the 工资保障计划(PPP) during the week of Jan. 11, 2021, “首次提取贷款”,“First Draw PPP贷款可用于帮助支付工资成本, 包括福利. 资金也可以用来支付抵押贷款, 感兴趣, 租金, 公用事业公司, 与COVID-19相关的工人保护费用, uninsured property damage costs caused by looting or vandalism during 2020, 以及某些供应商成本和运营费用. 查看更多有关首笔PPP贷款的信息, 包括完全的宽恕条款, 谁可以申请?, 和更多的. 点击这里阅读PPP首次提取贷款.

>>> 薪水保障计划 (First Draw Loan) Application <<<

二次提取贷款

重要提示:根据2021年综合拨款法案, the PPP now allows certain eligible borrowers that previously received a PPP loan to apply for a Second Draw PPP Loan with the same general loan terms as their First Draw PPP Loan. These Second Draw PPP Loans can be used to help fund payroll costs, 包括福利. If you would like to learn more about Second Draw PPP Loans, 点击这里.

>>> 薪水保障计划 (Second Draw Loan) Application <<<

食肆振兴基金拨款

列入2021年美国救援计划法案, was a special order of grant money that was specifically set aside for restaurants that have sustained financial losses resulting from the COVID-19 pandemic. 美国.S. 小企业管理局(SBA), 谁负责管理这些资金, has been busy putting the final touches on the official application for the 食肆振兴基金拨款 (RRFG) and, 一旦上线, 政府机构将开始接受命令, 可以这么说, 先到者, 标间. 点击这里 to find out if your restaurant qualifies to receive a slice of the $28.60亿元拨款及如何申请!

为小企业提供的额外资源

寻求更多的帮助和见解, please check out the links below to learn more about the financial resources that are now available to employers.

IRS Issues Guidance That Impacts Deductibility Of Expenses Related To PPP Loan Funds

Finally, as it relates to the CARES Act, we have found a very helpful 常见问题解答 文档, 《小企业主关怀法案指南他来自参议院小企业和创业委员会. 请 take a look as it will likely answer many of the questions you may have about the CARES Act and its impact on your small- to mid-sized business.

主要街道贷款计划

The 主要街道贷款计划 is a new loan program that was recently announced by the Board of Governors of the 联邦 Reserve with financial support from the Department of the Treasury. 以下是一个高级概述:

- This program is available for any business that was established prior to March 13, 2020, and has:

- 多达15,000名员工或

- 2019年年收入不到50亿美元

- 你必须在2019年至少有83,333美元的EBITDA才有资格.

- The amount you can borrow is 6x your EBITDA minus your funded debt or credit lines (no including PPP) on the date you apply for the loan.

- 最低贷款金额为EBITDA的6倍,即50万美元.

- 最高贷款额为2500万美元

- 没有提前付款的处罚.

- 该计划可以与PPP和EIDL计划一起利用.

贷款条款如下:

- 4年

- LIBOR (1 month or 3 months) plus 300 basis points, depending on the underwriting

- No payments due for the first 12 months (unpaid 感兴趣 will be capitalized)

- Principal amortization of at least 15 percent at the end of the second year, 第三年结束时是15%, 在第四年结束时支付70%的高额利息

- 没有原谅的机会

If you think this program might be applicable to your situation, please contact your 意图 advisor.

免费点播网络研讨会

巴基斯坦人民党 & CARES Act task force has been working hard to provide businesses like yours with essential information related to the 薪水保障计划 and other cash flow generating activity. Check out these free on-demand webinars from financial experts and industry specialists for guidance.

的意图 & 比较靠谱的赌博软件 team is also producing webinars on a variety of other topics. 点击这里 查看过去的记录并注册未来的活动.

- 了解员工保留信用- 1月发布. 13, 2021

- 新的经济刺激法案对企业意味着什么? - 1月发布. 7, 2021

- PPP贷款减免申请流程,必要表格 & 税务处理- 12月发布. 8, 2020

- 新关怀法案资助小企业 & 非营利组织- 11月发布. 6, 2020

- Attaining Your Post-COVID Business Goals: The Transition From Uncertainty To Success - Released Aug. 25, 2020

- 管理业务增长 & 2019冠状病毒病疫情下的盈利能力. 18, 2020

- 恢复 & 在COVID-19的世界中繁荣发展- 2020年6月30日发布

- 薪水保护计划:最后一章? - 2020年6月26日发布

- Working Through 巴基斯坦人民党 Forgiveness Application - Released May 26, 2020

- 浏览PPP宽恕 & 认证指南- 2020年5月14日发布

- 浏览PPP宽恕 & 主街贷款计划介绍- 2020年4月28日发布

- 浏览您的银行关系 & PPP贷款减免- 2020年4月15日发布

- 如何申报小企业管理局灾难 & 关怀法案贷款-记录2020年3月31日

俄亥俄州小企业发展中心

Here is a list of several of Ohio's Small Business Development Centers. 请 让我们知道 如果你想让我们包括更多的县.